Table of Contents

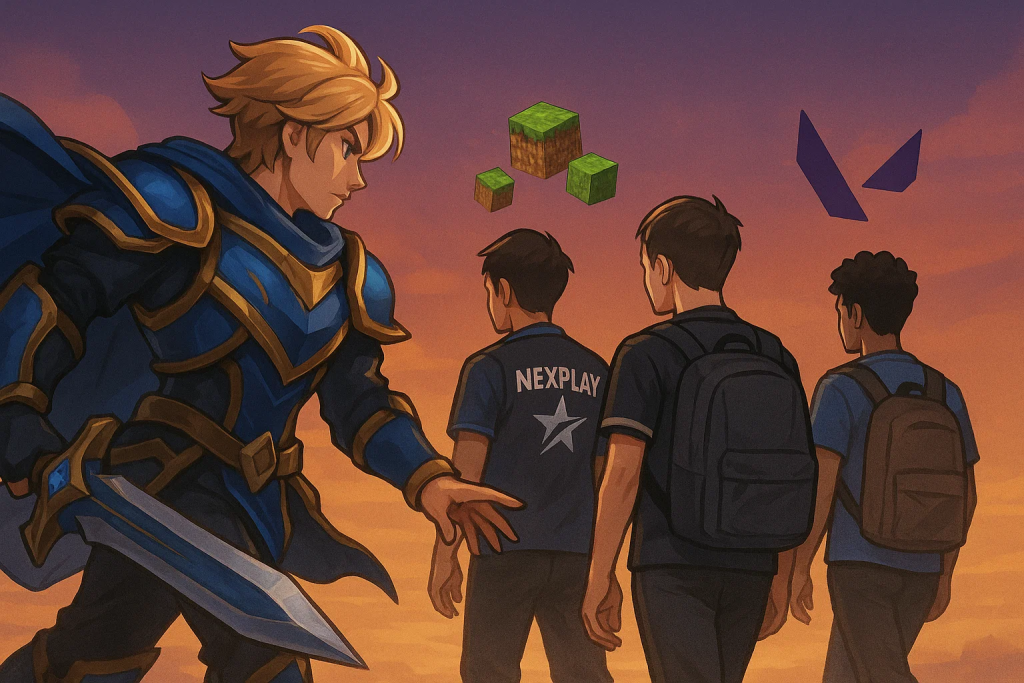

In July 2025, a storyline years in the making finally snapped into place: Nexplay’s “Big 3”—Yawi, H2WO, and Renejay—collectively left their MLBB homes and joined Honor of Kings (HoK), reuniting with longtime mentor Akosi Dogie. The move, announced across newsrooms and official social pages, crystallized a trend: high-profile Philippine MLBB talent hedging into a fresh ecosystem with global ambitions, local leagues, and aggressive creator programs.

But here’s the twist most hot takes miss: MLBB itself isn’t collapsing—in fact, its 2025 Mid Season Cup (MSC) set all-time Esports World Cup viewership records. The exodus is less about a dying game and more about portfolio logic: new title economics, contract cycles, sponsor alignment, and the chance to be “founders” in a scene that just went global.

Below, we unpack the who, what, and why—and offer a playbook for teams, brands, and players navigating the two-MOBA future.

1) Who exactly are the “Nexplay stars,” and why their moves matter

Nexplay’s rise through MPL-PH in the early 2020s minted a trio of household names: Tristan “Yawi” Cabrera, John Paul “H2WO” Salonga, and Renejay “Renejay” Barcarse. Under the Nexplay / Nexplay EVOS banner and the public-facing leadership of Akosi Dogie, the group built massive fan affinity before their careers diverged across rival orgs (ECHO, RSG PH, Blacklist, TNC, Aurora). In mid-2025, all three announced a synchronized pivot to Honor of Kings, signaling a rare, coordinated leap across titles rather than the usual inter-team transfer.

The broader Nexplay lineage also matters. The EVOS–Nexplay joint venture that once carried the NXPE name later rebranded to Minana EVOS; by July 2024, EVOS pulled out of the Philippine market, and the slot ultimately changed hands again. That churn underlines a fluid domestic ecosystem in which rosters, rights, and revenue models keep evolving—exactly the kind of volatility that makes cross-title opportunities attractive to star talent.

2) What changed in 2024–2025 in Nexplay: the HoK catalyst

The single biggest external catalyst was Honor of Kings’ global launch. After years as China’s juggernaut MOBA, HoK went worldwide on June 20, 2024, with immediate traction in the Philippines and across SEA. Press materials and independent coverage cited top download charts region-wide and tens of millions of new installs within the first month—clear signals to players and sponsors that HoK’s expansion wasn’t a test balloon, but a full-scale market entry.

HoK then layered localized paths to pro—from Philippine qualifiers for the world championship to domestic productions (like PKL hosting moves) and a growing roster of PH creators (ChooxTV among them) officially tapped to grow the scene. For veteran MLBB talent, the message was simple: there’s a funded runway here—with new leagues, sponsor inventory, and creator budgets to match.

And yes, the optics mattered: HoK publicly reunited Akosi Dogie with Nexplay’s Big 3 via official assets and press. For fans, that “road-movie reunion” narrative was irresistible; for talent, it created a soft-landing pack with built-in chemistry, brand value, and shared content pipelines on day one.

3) “Is MLBB dying?” The data says no

Before we go further, let’s deal with the myth. MLBB’s 2025 Mid Season Cup didn’t just hold; it broke records, crossing 3.06M+ peak viewers and 50M+ hours watched—the most-watched event of the Esports World Cup to date and among the biggest esports broadcasts of the year. Whatever personal preferences talent may have, MLBB’s audience and event health remain strong. This isn’t an obituary; it’s market expansion.

Takeaway: the “exodus” is not talent fleeing a sinking ship; it’s top players diversifying into a second, newly global ecosystem that finally exists at scale in the Philippines.

4) Why Nexplay stars switch titles: 8 drivers behind the Nexplay moves

4.1 First-mover advantage in a new league

When a title launches globally, early entrants can become face-of-the-scene faster than in a saturated ecosystem. Nexplay alumni get to rewrite their legacy as HoK pioneers, not just as “former MLBB champions.”

4.2 Fresh sponsor inventory and creator budgets

New game = net-new sponsor space (phone brands, peripherals, telcos) with less clutter. Add HoK’s creator outreach (e.g., ChooxTV’s official tie-up), and pros can package dual revenue: esports + content.

4.3 A built pathway to pro (and story arcs)

PH qualifiers to global stages, localized leagues/productions, and familiar broadcast faces (hosts, analysts) mean pro scaffolding already stands. That lowers the risk of jumping.

4.4 Contract cycles & organizational churn

Between EVOS’ exit and rebrands, the MLBB org map in PH keeps shifting. Contract expirations around mid-year made July 2025 perfect for synchronized moves.

4.5 Meta fatigue & competitive novelty

Even a healthy esport can feel “solved” for veterans. Switching to HoK provides new micro/macro puzzles—and fresh highlight angles—without abandoning the MOBA skillset.

4.6 Creator-led reunions

The Dogie & Big 3 reunion offered instant chemistry, nostalgia, and audience carry-over, accelerating the ramp for streams, shorts, and live events.

4.7 Audience overlap but platform diversification

HoK’s TikTok-first marketing blends with YouTube/Twitch pipelines pros already own, spreading risk across platforms and stabilizing CPMs during algorithm swings.

4.8 Global prize circuits & discovery

With worldwide roll-out and big regions, HoK promises new international storylines for Filipino talent—a powerful motivator after years of MLBB regional dominance.

5) Case study: The Nexplay Big 3 reunion—how a narrative becomes a growth engine

The announcement cadence was telling: departures from MLBB rosters, followed within hours by HoK reveal content across news sites and official social channels. The framing wasn’t “running from MLBB,” it was “leveling up to a global frontier,” with Dogie positioned as both mentor and content magnet. That orchestration gave fans a clean storyline: new title, same personalities, a familiar huddle—just in a fresh arena.

Why it works:

- Continuity: fans didn’t have to pick between personalities and a game—they followed the personalities.

- Cross-pollination: ex-Nexplay audiences became HoK-curious, while HoK newcomers met the PH scene through creators they already knew.

- Sponsor clarity: brands saw a cohesive creator pod they could book together (cheaper integration, bigger lift).

What to watch next: early tournament results, co-stream performance, and whether additional PH pros seek similar reunions.

6) “Two MOBA future”: what this means for the Philippine ecosystem

6.1 For MLBB

Ironically, the exodus could sharpen MLBB’s storylines. With tentpoles like MSC 2025 breaking records, the league has a luxury problem: keep innovating on content, format, and creator partnerships while holding a massive base. Expect more cross-platform rights (YouTube + TikTok Live), co-streaming, and localized fan fests to defend mindshare.

6.2 For HoK

The window is open right now. HoK can convert curiosity into habit via consistent PH leagues, transparent talent contracts, creator reward programs, and brand-safe content. People follow routines—weekly shows, talent scrims, and predictable “lore drops” build that habit.

6.3 For fans

You don’t have to pick sides. The net result is more matches, more content, and more PH faces on world stages. Treat this like switching TV channels rather than moving house.

7) Action playbook for teams (org owners & GMs)

1) Build dual-title rosters (12-month view).

- Maintain an MLBB core if you’re entrenched, then seed a HoK cell (2–3 veterans + 2 prospects).

- Use scrim exchanges and shared sports science so both squads benefit from each other’s prep.

2) Codify IP & content pipelines.

- Structure creator sub-teams (editors, thumbnail artists) to repurpose VOD → Shorts → TikTok.

- Lock weekly pillars: VOD reviews, skill clinics, town halls. Consistency beats virality.

3) Talent contracts with optionality.

- Draft addenda for cross-title activity, revenue share on creator deals, and safeguards if a title pauses domestic events.

4) Data & dashboards.

- Track on-stream growth, retention, hours watched, and brand lift across MLBB and HoK.

- Benchmark against Esports Charts metrics to negotiate rights and sponsor rates.

5) Fan clubs, not followers.

- Enable membership perks (Discord roles, early merch drops, meetups).

- Run watch parties that flip passive fans into active communities.

8) Action playbook for brands & sponsors

1) Book pods, not lone wolves.

Creator pods (e.g., Dogie + Big 3 + a host) deliver cohesive story arcs and shared audiences, reducing CPM and creative risk.

2) Go “dual-MOBA” where possible.

Package deliverables that span MLBB + HoK: educational series (hero fundamentals), wellness content (sleep, nutrition), and tech explainers (devices, network).

3) Demand safety by design.

- Include brand safety clauses, content reviews, and crisis response SLAs.

- Favor education/positive rivalry angles over flamebait.

4) Measure full-funnel.

Track retention, saves, qualified comments, and offline activations (events, retail tie-ins) alongside top-line views.

9) Action playbook for players (pros & aspirants)

A) Crossover skill map (30 days).

- Week 1: Mechanical acclimation—control mapping, camera behavior, timing drills (last-hit windows, dash cancels).

- Week 2: Macro—objective windows, lane swaps, vision discipline unique to the new map.

- Week 3: Draft literacy—tier list by role; three comfort picks + two counters.

- Week 4: Stage simulation—scrims with streamed comms; post-match VOD notes.

B) Content as a second contract.

- Publish 2 shorts/day (tips, positioning), 1 VOD/week, and 1 live session with Q&A.

- Build Notion sheets for title-specific terms so viewers learn with you.

C) Wellness & longevity.

- Sleep 7–9 hours; eye breaks every 20 minutes; strength & mobility 3x/week.

- Coach your voice (diction, pacing) to reduce stream fatigue.

10) The money question: where does ROI look best?

- MLBB currently offers huge broadcast reach; if your KPI is brand awareness, MLBB tentpoles remain unmatched in PH mobile esports.

- HoK is the growth option: a leaner field with first-mover halo for talent and brands that commit early. Its PH creator push and local events are tailwinds.

Smart move: split budgets 70/30 (MLBB/HoK) through Q1 next year, then rebalance based on league calendars and PH-specific viewership.

11) Narrative watchlist (Q3–Q4 2025)

- Results & rivalries: Do Big 3 podium in early HoK tournaments? Do MLBB storylines birth new stars to fill the narrative gap?

- Platform wars: TikTok Live vs YouTube Live co-streams and how they shape both MOBA ecosystems.

- Org reshuffles: Post-EVOS exit ripple effects; who buys, sells, or merges next?

- Creator economy: More PH names (hosts, casters) switching? (e.g., Mara Aquino to HoK PKL.)

12) Don’t get trapped by false binaries

The two-MOBA future is normal: CS + VALORANT, Dota 2 + League, FIFA + eFootball—titles can coexist, cross-pollinate, and even grow each other. The Philippines has the audience, talent, and brands to run parallel circuits. The “exodus” headline grabs clicks; the reality is portfolio diversification across two strong products.

Final word

The “Nexplay exodus” isn’t a funeral for MLBB—it’s a graduation into a two-title era. When a juggernaut like Honor of Kings enters the Philippines with global circuits, creator budgets, and local leagues, ambitious talent will test the waters. At the same time, MLBB continues to set records, proving there’s room for both. For teams, brands, and players who plan rather than panic, the next 12 months look less like a split and more like an expansion pack—two MOBA worlds, one Philippine audience, and endless stories to tell.

In July 2025, Nexplay’s “Big 3” — Yawi, H2WO, and Renejay — made a coordinated leap from Mobile Legends: Bang Bang (MLBB) to Honor of Kings (HoK), reuniting with mentor Akosi Dogie. The move capped years of brand-building and follows organizational churn around Nexplay/EVOS/Minana, contract expirations, and HoK’s aggressive global expansion. Crucially, this is not an MLBB collapse story: MLBB’s 2025 Mid Season Cup set record viewership, proving the title’s audience remains robust. The “exodus” is better read as portfolio diversification: stars chasing first-mover status, fresh sponsor inventory, and new storylines within a second, now-global MOBA ecosystem.

Why switch? Eight drivers explain the pivot: (1) first-mover advantage in a new league; (2) bigger creator budgets and sponsor headroom; (3) clear PH pathways to pro and global stages; (4) contract cycles and org reshuffles; (5) meta fatigue and desire for novelty; (6) creator-led reunion optics; (7) platform diversification across TikTok/YouTube; and (8) new international prize circuits.

Implications.

- MLBB: doubles down on tentpoles, co-streams, and fan events to defend mindshare.

- HoK: must cement habits via consistent PH leagues, transparent talent deals, and creator programs.

- Fans: don’t need to pick sides — expect more matches and more local faces on world stages.

Playbooks.

- Teams: build dual-title rosters, standardize content pipelines, add cross-title clauses, track data, and cultivate paid fan clubs.

- Brands: book creator pods (e.g., Dogie + Big 3), split spend 70/30 (MLBB/HoK) initially, require brand-safety clauses, and measure full-funnel outcomes.

- Players: follow a 30-day crossover plan (mechanics → macro → drafts → stage simulation), publish consistent content, and protect wellness for longevity.

Bottom line: The Philippine scene is entering a two-MOBA era. With MLBB thriving and HoK surging, the smartest stakeholders won’t panic — they’ll diversify, tell better stories, and meet audiences wherever the action goes.

Karate Kids: Amazing PH Performers Shine at SEA Games Qualifiers

Call to action

- Players & coaches: Drop your role, rank, and whether you’re eyeing MLBB, HoK, or both. I’ll reply with a 14-day crossover plan (mechanics + macro + content).

- Teams: Share your roster status (locked MLBB / exploring HoK) and Q4 sponsor goals. I’ll sketch a dual-title content calendar that de-risks your pipeline.

- Brands: Tell me your KPI (reach vs. trust vs. sales) and budget tier. I’ll recommend a 70/30 split, creator pods, and safety clauses you should add to contracts—today.